Which Asset Class Performed Best in Q4 2018

Russell 1000 Value and Growth Mid. How oil gold and copper performed in 2018.

Q4 2018 Xrp Markets Report Ripple

In the 12 months to 31 st March 2018 just over 21000 searches were carried out in CAMRADATA Live.

. Foreign stocks did worse with Developed Markets 3 and Emerging Markets -0 finishing down slightly on the quarter. Ups and downs by 20 30 or even more are not unusual for Bitcoin and its current value is still 52 below its 2017 peak. US Small Caps still did well 4 but underperformed.

Glancing down the list of regional and country stock indices provided by MSCI its clear that stocks got hammered in 2018. The Asset Quilt. South Florida Assets Performed Well In Q4 The other asset classes performed well too according to a report by data firm Vizzda and the MIAMI Association of Realtors Commercial.

Russell 2000 Value and. APAM Q4 2018 Earnings Conference Call Feb. The US economy will likely have grown around 3 in 2018 4Q GDP data to be released on Jan 30 estimate 27.

A number of investors were clearly in liquidation mode. 2013 Net assets flows in Western Europe 2020 by. Markets represented by respective Russell indexes for each category Large.

The chart above reveals that Bitcoin has been the worst asset in terms of volatility. To virtually any risky asset class. Q4 was a very strong quarter with a mid-quarter dip for US Large Cap 11 and US Real Estate 15 but other asset classes fared substantially worse.

05 2019 1100. Among the nine style boxes Large Value performed the best and posted a -117 decline and Small Growth posted with worst decline of -217. While there is still no predictive power in this data I updated those charts as of the end of Q4 2017 for those of you that are interested see below.

World-performed-4th-quarter-2018 We think the best course of action is to ignore. Looking at Q4 2018 the bifurcation of performance continued with equities selling off sharply while the other asset classes and the SP. According to the most recent Asset Quilt of Total Returns put together by Bank of America Merrill Lynch commodities are the top returning asset class of 2018 so far.

For the last few quarters Ive posted returns by asset class by representative ETF as well as year-to-date last twelve months and last five years. Q4 2018 may not be a stellar example of the power of diversification but it underlines the need to maximize the so-called only free lunch in finance When equities are given an outsized risk allocation equity market losses like. Despite what occurred within the equity markets in.

Fixed income assets 33 per cent of the universe held up strongest with a 1 per cent YoY decline 5 per cent during Q4. The chart which shows the total returns of asset classes over the years has commodities at an annualized return of 227 year-to-date. Many of the best performing sectors and stocks year-to-date before the drawdown were the worst performers in October and December.

Artisan Partners Asset Management Inc NYSE. Best performing asset classes worldwide 2016 Asset classes - return expectations on assets in the US. 50 products were also added to CAMRADATA Live which focused on several different strategies including China Equity Japanese Equity European Fixed Income and US Corporate.

Asset class 31122018 ISKm Unlisted equities delivered very good return in FY18 mostly due to stakes in HSV holding company S121 and Arnarlax Listed equities performed very poorly in FY18 which is mostly attributable to a stake in Sýn as well as investments in real estate companies 3286 Listed equities and funds 6314 Equities and funds. As the chart below shows while oil and copper have fallen gold has largely retained its value. If the reverse is true then investors tend to put their money into gold because gold is a physical asset more easily converted into cash and seen as protection against inflation.

In March 2018 the top three most searched asset classes were Global Diversified. Between December 2017 and December 2018 Bitcoin crashed a stunning 83 from USD 19497 to USD 3242. Overall 2018 was a year the markets would just as soon forget.

As detailed below US stocks fell 5 international stocks fell 14 and commodities did worst of all giving up 15 for the year. Russell Mid Cap Value and Growth Small. Q4 2018 was the third worst fourth quarter since 1950 for the SP 500.

Among Global FI it is multi sector and flexible strategies that grew the most. Supported by a 15 trillion tax cut package that boosted consumer spending to four-year highs personal consumption accounts for nearly 70 of GDP. The largest sector groups Global and EM FI performed best with full year asset appreciation of 4 per cent and 5 per cent respectively.

The year was helped by particularly strong Q2 and Q3 GDP growth of 42 and 34 respectively. Also there is a strong body of evidence that suggest buying closed end. Cash bonds defensive currencies like the dollar and yen and precious metals did relatively better and helped with diversification but its almost impossible to find an asset class that really.

Mills Wealth Q4 2018 Market Commentary. This fund is trading between 10-12 below is assets book value and this asset class is projected to be one of the highest returning assets.

Where People Invest During Stock Market Crash Usa Q4 2018 Crash Personal Finance Money Stack Exchange

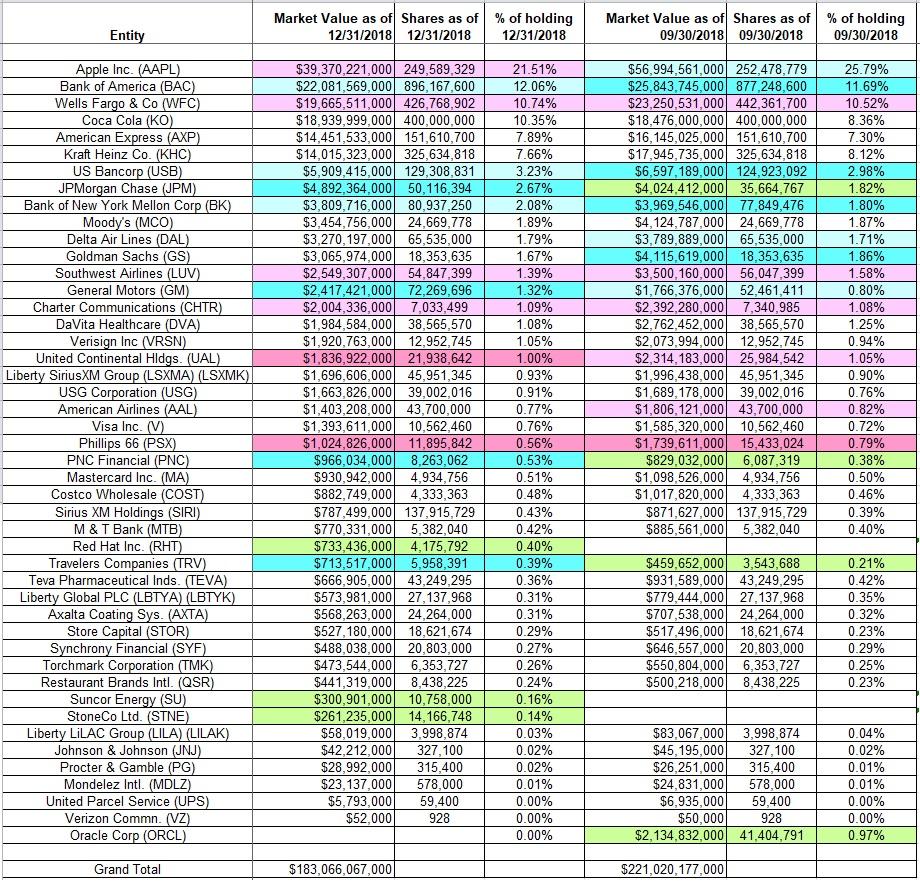

Tracking Warren Buffett S Berkshire Hathaway Portfolio Q4 2018 Update Nyse Brk A Seeking Alpha

Investors Show Strong Preference For Select Asset Classes And Are Optimistic For The Second Half Of 2021

No comments for "Which Asset Class Performed Best in Q4 2018"

Post a Comment